Legal

HB 3749, Greg Abbott, and... John Oliver?

HBO's Last Week Tonight with John Oliver discussed public concerns about how med spas operate.By Alex Thiersch, CEO, AmSpaJohn Oliver ...

Show your committment to patient safety, legal compliance and community over competition.

AmSpa members receive preferred pricing on all AmSpa live and virtual trainings.

Get the latest news and information about safe, legal practice in medical aesthetics directly in your inbox.

Get access to med spa laws, in-person and online training and more!

Posted By Mike Meyer, Thursday, March 14, 2019

By James M. Stanford, JD, Partner, ByrdAdatto

Over the last several years, private equity activity progressively made its entrance into the market of dental support and management service organizations. Now, the trend has made its way into the practice of dermatology, and the field is divided over the rise of private equity—not only in dermatology, but in other areas of medicine as well, including plastic surgery, aesthetics, and the medical spa space. The competing schools of thought on private equity in medicine are highlighted in an article recently published by The New York Times entitled, "Why Private Equity is Furious Over a Paper in a Dermatology Journal."

The article details the backlash a medical research paper received after its data supported a conclusion that private equity firms tend to acquire practices "that perform an unusually high number of well-reimbursed procedures and bill high amounts to Medicare." The article also highlights the criticisms over the paper's factual accuracy, its sudden removal from the medical journal's website, and the questions raised about private equity firms' growing presence and influence in the practice of dermatology at the expense of patient care.

While the corporatization of healthcare is not a new debate, the research paper's conclusion is the most recent example to illustrate the challenges that arise in maximizing profits without diminishing patient care. This is because the ability of a practice to effectively align its healthcare and business issues can be the differentiating factor between the success and failure of the practice. On one side of the equation, you have the traditional healthcare practice structure where business innovation and creativity is extremely limited, and the primary focuses are patient care, efficiency in billing and operations, and payer reimbursements. On the other side, you have the retail business structure where there is a limited understanding with healthcare laws and regulations and the correlated risks of excessive monetary penalties and lawsuits, but its experts are skilled in innovative marketing and branding.

Like it or not, private equity has made its way into the dermatology market and other health care spaces. If you have a management service organization and need help navigating the challenges of raising private funds, or if you are currently operating with private equity backers and need guidance, consider attending one of AmSpa's upcoming Boot Camps, where industry leaders can answer your questions and show you how to move your business forward.

James M. Stanford is an attorney and partner at the ByrdAdatto law firm. From transitions, mergers, and acquisitions to structuring complex ownership arrangements, James enjoys the personal reward that comes from bringing parties together and making deals happen. James practices primarily in the areas of health care and corporate law with a focus on intellectual property. A proud father, Jim served in the U.S. Army and is fluent in Russian. In his spare time, he enjoys hunting, fishing, and spending time outdoors.

Related Tags

Medical spa news, blogs and updates sent directly to your inbox.

Legal

HBO's Last Week Tonight with John Oliver discussed public concerns about how med spas operate.By Alex Thiersch, CEO, AmSpaJohn Oliver ...

Trends

By Patrick O'Brien, JD, general counsel, and Kirstie Jackson, director of education, American Med Spa AssociationWhat is happening with glucagon-like ...

Trends

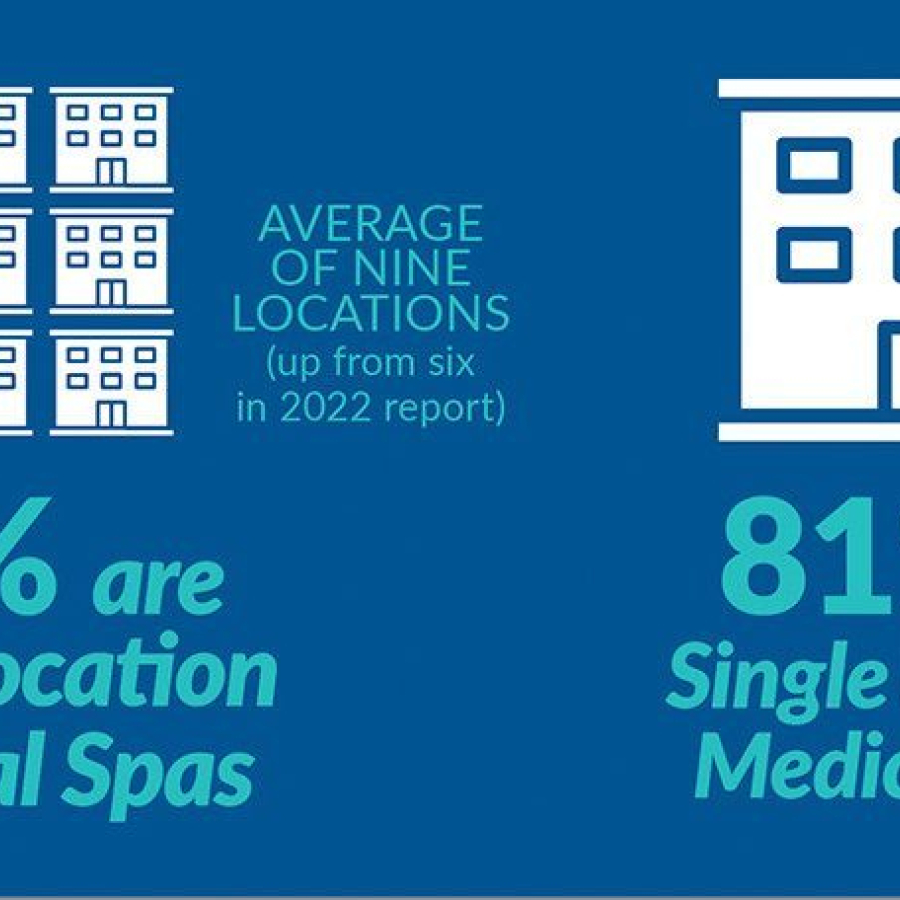

By Michael Meyer Approximately every two years, the American Med Spa Association (AmSpa) releases its Medical Spa State of ...

Trends

By Michael Meyer Since the beginning of 2024, it seems like medical aesthetics has taken one hit after another ...