Legal

HB 3749, Greg Abbott, and... John Oliver?

HBO's Last Week Tonight with John Oliver discussed public concerns about how med spas operate.By Alex Thiersch, CEO, AmSpaJohn Oliver ...

Posted By Madilyn Moeller, Wednesday, November 6, 2024

By Michael Meyer

Approximately every two years, the American Med Spa Association (AmSpa) releases its Medical Spa State of the Industry Report, which is built on a survey of medical spa professionals and is designed to help people understand the realities of the industry and make more informed decisions using data collected from providers across the industry. As part of the release of the 2024 report, AmSpa has released its free Executive Summary, a sampling of some of the high-level findings in the report. Here is a quick recap of the findings in the Executive Summary and reflections on what they mean.

The medical aesthetics industry continues the steady growth it has experienced in the past 15 years, growing from 8,899 locations in 2022 to 10,488 in 2023. This reflects a consistent confidence in the continued consumer demand for medical aesthetics treatments. It also suggests that this demand is not close to being satisfied. As aesthetic treatments continue to offer patients innovative solutions and offer owners the opportunity to make good money, there is no reason to believe the increase in the number of medical spas in the U.S. will stop anytime soon.

Speaking of making good money, this finding demonstrates that despite the increase in the number of medical spas, the average revenue at medical spas continues to grow. Again, this suggests that patient demand continues to increase, and that while there are more medical spas to address this demand, they have not yet reached a saturation point where their profits are adversely affected by this increase in availability.

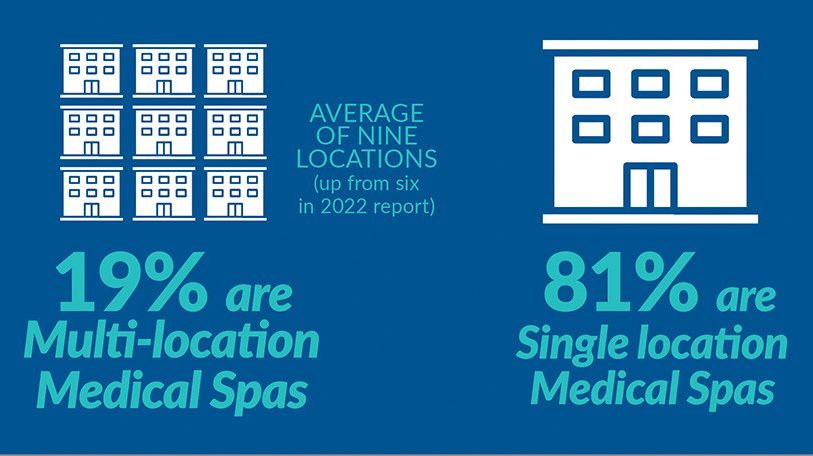

Medical spa owners and operators embody the ethos of the small businessperson, and the fact that so many medical aesthetics businesses are single-location, and that these businesses typically bring in high amounts of revenue, suggests that the medical aesthetics industry offers people a unique opportunity to become successful on their own terms.

This finding shows that many of the people and groups who own medical spas with multiple locations tend to have a lot of them. This demonstrates an increase in the number of large medical spa chains in operation in the U.S., as well as a certain amount of consolidation in the industry via mergers and acquisitions, although elsewhere in the report, it is revealed that the amount of M&A activity respondents report taking place is surprisingly low.

This suggests that medical spa owners believe in the continued strength of demand for medical aesthetics treatments. Furthermore, 54% of the 84% of medical spa owners who answered that they expected revenues to rise state that they believe the increase will be at least 10%, so many medical spa owners clearly think that, as of now, there is still plenty of demand for medical aesthetics treatments that is not being met.

For many years, those who follow medical aesthetics have predicted that the ratio of women to men who undergo medical spa treatments would become more balanced in the future, but that increase in male patients continues to exist only in the realm of speculation. It may be safe to say that if we haven’t seen an increase in male patients by now, it may never happen, but that doesn’t mean you should stop marketing to male patients; in fact, it stands to reason that those medical spas that market effectively to both men and women have a decided advantage over those that only successfully market to women.

This number is almost exactly the same as it was in 2018 and down a bit from the artificial high of the pandemic years. This seems to be roughly the number of monthly visits at which a typical medical spa should find itself without any unusual outside influences.

This number is up from 65% in the 2022 report, a significant increase. Notably, this suggests that the field of medical aesthetics is becoming more established as part of American society and that an increasing number of people are incorporating medical spa treatments as parts of their lives. As the industry continues to expand, it’s likely that this number will continue to increase incrementally for a while, although it will level off eventually.

Additionally, women 55 and older make up 24% of female patients, while women 18-34 make up 22%. This represents a small but noticeable shift from 2022, when women 18-34 made up 26% of female patients, women 35-54 made up 52% and women 55 and older made up 21%. All this suggests that the patient base for medical aesthetics is growing ever so slightly older, and while older patients continue to remain engaged (see the previous statistic regarding repeat patients), younger patients are not entering the space quite as quickly. On one hand, this is a bit concerning, since it’s ideal to get people into the habit of undergoing medical aesthetics procedures at a young age, but it also presents an opportunity for those who relish a marketing challenge. Younger people who would benefit from medical aesthetics procedures are clearly out—you just need to figure out how to entice them to come into your medical spa

This is roughly in line with the $536 figure from the 2022 report, which is a good sign, since that number was likely inflated a bit by the post-lockdown rush. Of course, inflation likely plays a role in the relative strength of this figure, but regardless, it suggests that medical aesthetics patients are willing to spend on treatments that improve their appearance and sense of self-esteem.

This is a slight increase from the 17% figure in the 2022 report, and it suggests that the perceived growth of medical aesthetics is not slowing down. Entrepreneurs and medical professionals continue to be willing to invest in opening medical spas, so they must continue to see a great deal of potential in the field.

The category of “non-MDs/surgeons” includes nurse practitioners (NPs), registered nurses, physician assistants (PAs), entrepreneurs, aestheticians and others. Notably, NPs have nearly pulled even with MDs and surgeons as the group with the highest percentage of medical spa ownership with a significant increase over the figure in the 2022 report. This is likely due to legislation passed in many states in recent years that permits independent practice by NPs. In that respect, it will be interesting to see if PAs begin to make strides in this category in subsequent reports, as they are also beginning to benefit from legislation permitting independent practice in several states.

Some might find this figure unexpectedly low and may be further surprised to learn that it is the same as it was in the 2022 report. Given the emergence of a number of medical aesthetics-focused investment firms in recent years and some high-profile acquisitions, it is reasonable to assume that mergers and acquisitions are an industry-wide trend, but that particular market is, by and large, still developing and will likely become a larger factor in subsequent years.

The “core specialties” in medical aesthetics refers to plastic surgery, facial plastic surgery, oculoplastic surgery and dermatology. It stands to reason that people specializing in these areas would be the driving forces behind medical aesthetics, but as the industry has grown and matured, it has become less and less common for physicians from these four specialties to become medical directors in aesthetics practices. This number is up from 69% in the 2022 report, and as the backgrounds of people who enter the field continue to diversify and NPs and PAs continue to gain practice independence, this number may very well continue to increase.

The role of medical director at a medical spa is vitally important, because a medical director is responsible for all the medical decisions in the practice; these are often delegated, of course, but at the end of the day, the buck stops with the medical director. And while this number suggests a great deal of turmoil in this role, you also must consider that, as stated above, 18% of medical spas were newly opened in the last year, and many of them necessarily hired a medical director, so the amount of turnover in the role is much lower than this number suggests. Still, it can be difficult to find a good match between medical spa and medical director, and this certainly reflects that many aesthetics practices are still searching for the right match.

This statistic considers only medical spas owned by medical professionals, and like the previous finding regarding non-core medical directorship, it suggests medical spas are increasingly the domain of a wide variety of medical professionals, not just the people whose course of study most closely resembles the field. Medical aesthetics benefits from this diversity of backgrounds, as shown by innovations such as IV therapy and medical wellness treatments, which have very little to do with facial plastic surgery or dermatology.

This number has remained steady for single-location practices, but has dropped somewhat dramatically for multi-location practices at their primary location, from 16 in the 2022 report. While it’s tempting to say that this might be a result of staff size correction after the rush of post-pandemic customers subsided, it’s also worth noting that the 2024 figure is also substantially lower than the one in the 2019 report, when multi-location practices employed an average of 15 people at their primary location. There are several potential reasons why this number has declined, but it’s certainly a trend worth keeping an eye on moving forward.

This is just a tiny sample of the information contained in the 2024 Medical Spa State of the Industry report. The full report is available for free to AmSpa Plus Members and 50% off for Basic Members; non-members can purchase the report at full price ($995). Go to Med Spa State of the Industry Report to download or purchase the full report or visit www.americanmedspa.org/become-a-member to become an AmSpa Plus member.

AmSpa Members receive QP every quarter. Learn how to become a member and access the resources you need to succeed in the medical aesthetics industry.

Related Tags

Medical spa news, blogs and updates sent directly to your inbox.

Legal

HBO's Last Week Tonight with John Oliver discussed public concerns about how med spas operate.By Alex Thiersch, CEO, AmSpaJohn Oliver ...

Trends

By Patrick O'Brien, JD, general counsel, and Kirstie Jackson, director of education, American Med Spa AssociationWhat is happening with glucagon-like ...

Trends

By Michael Meyer Approximately every two years, the American Med Spa Association (AmSpa) releases its Medical Spa State of ...

Trends

By Michael Meyer Since the beginning of 2024, it seems like medical aesthetics has taken one hit after another ...