-

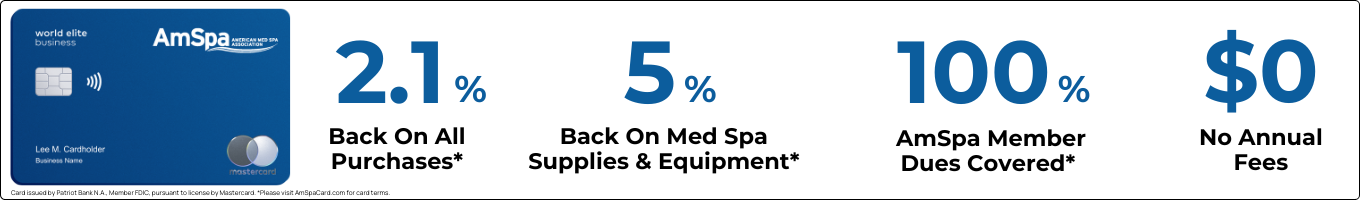

Membership

Become a Member

Show your committment to patient safety, legal compliance and community over competition.

-

Training

Join and Save

AmSpa members receive preferred pricing on all AmSpa live and virtual trainings.

-

Blog & News

Latest Blog Posts

View All PostsDon't Miss an Update

Get the latest news and information about safe, legal practice in medical aesthetics directly in your inbox.

-

Resources

Ready to Get Started?

Get access to med spa laws, in-person and online training and more!

- Contact Us

- Become A Member